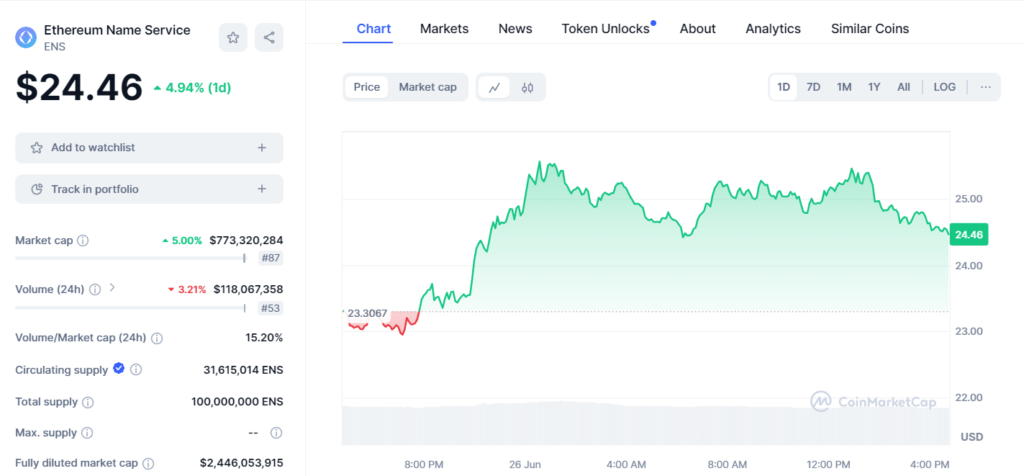

The Ethereum Name Service (ENS), known for linking Ethereum blockchain addresses with human-readable names, has recently seen a significant increase in its market value. The price of ENS tokens rose by 4.93% in a single day to $24.46. This increase is not just a trivial fluctuation; it signifies growing interest and potential in ENS’s role within the blockchain ecosystem.

ENS’s market capitalization has expanded by 4.99%, reaching $773,259,703, which ranks it 87th among cryptocurrencies. This growth in market cap is a robust indicator of rising investor confidence and a strengthening position in the competitive crypto market. Such an upturn is particularly noteworthy at a time when the broader market faces challenges ranging from regulatory scrutiny to volatile economic conditions.

The trading volume for ENS also saw a rise, albeit a modest one of 3.24%, totaling $118,034,973. This places ENS 53rd in global cryptocurrency trading volumes. The volume-to-market cap ratio of 15.20% is an important metric, indicating a healthy level of activity relative to the size of the market cap. It suggests that while ENS is becoming more popular, it remains stable and liquid, a positive sign for potential investors.

One of the critical aspects of ENS is its supply metrics. The circulating supply of ENS is currently 31,615,014 tokens, a fraction of the total supply capped at 100,000,000 ENS. This limited circulating supply against a fixed total can lead to increased demand and, subsequently, a rise in price as the utility and adoption of the Ethereum Name Service grow. The lack of a maximum supply further adds a layer of complexity to its market dynamics, potentially influencing its valuation over the long term.

The fully diluted market cap of ENS, which assumes that all tokens are in circulation, would be $2,445,862,292. This valuation provides insights into the maximum market value of the token and is essential for understanding the total economic impact ENS could have if it reaches full circulation.

The recent uptick in ENS’s market performance can be attributed to various factors. Primarily, the increasing integration of blockchain technology into everyday applications makes ENS’s services more relevant than ever. As digital assets become commonplace, the need for user-friendly, secure methods for managing these assets grows. ENS addresses this need by simplifying the transaction processes on the Ethereum network, making it easier for users to manage and transact using their digital assets.

Additionally, the broader trends in the cryptocurrency markets, such as the movement towards decentralized finance (DeFi) and non-fungible tokens (NFTs), where ENS can play a significant role, may also contribute to its growing valuation. The overall increase in the adoption of Ethereum-based applications could boost ENS’s visibility and desirability as well.

For investors and participants in the cryptocurrency market, ENS offers a fascinating opportunity. It embodies a blend of utility, innovation, and growth potential that is increasingly sought after in the crypto space. However, like all investments in this sector, it comes with its risks, primarily due to market volatility and regulatory uncertainties.

In conclusion, the recent performance of ENS is a testament to the growing importance of user-friendly blockchain solutions in promoting wider adoption of cryptocurrency. As the Ethereum Name Service continues to evolve and expand its offerings, it will likely remain a key player in the blockchain infrastructure landscape, presenting new opportunities and challenges for investors.

+ There are no comments

Add yours