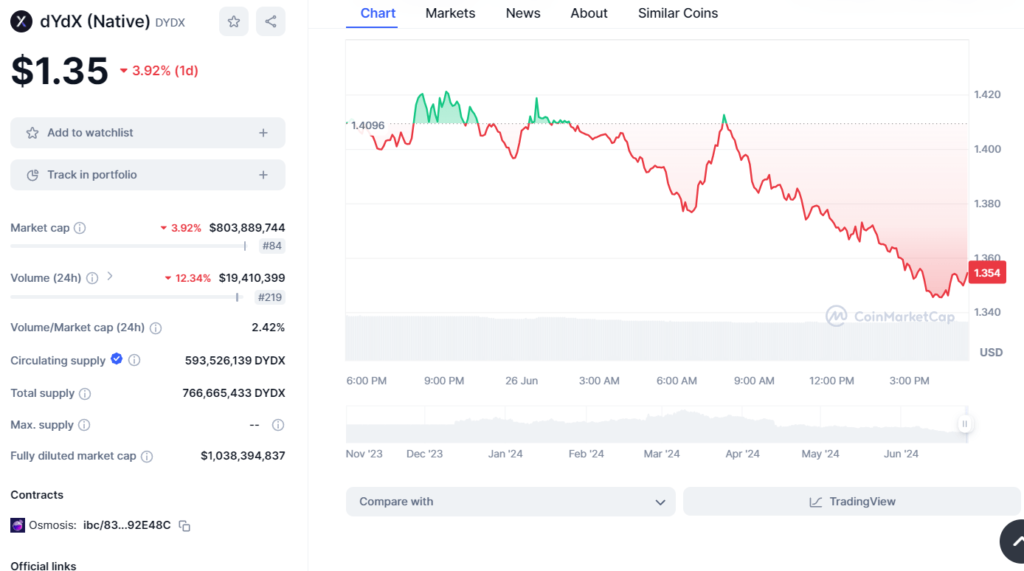

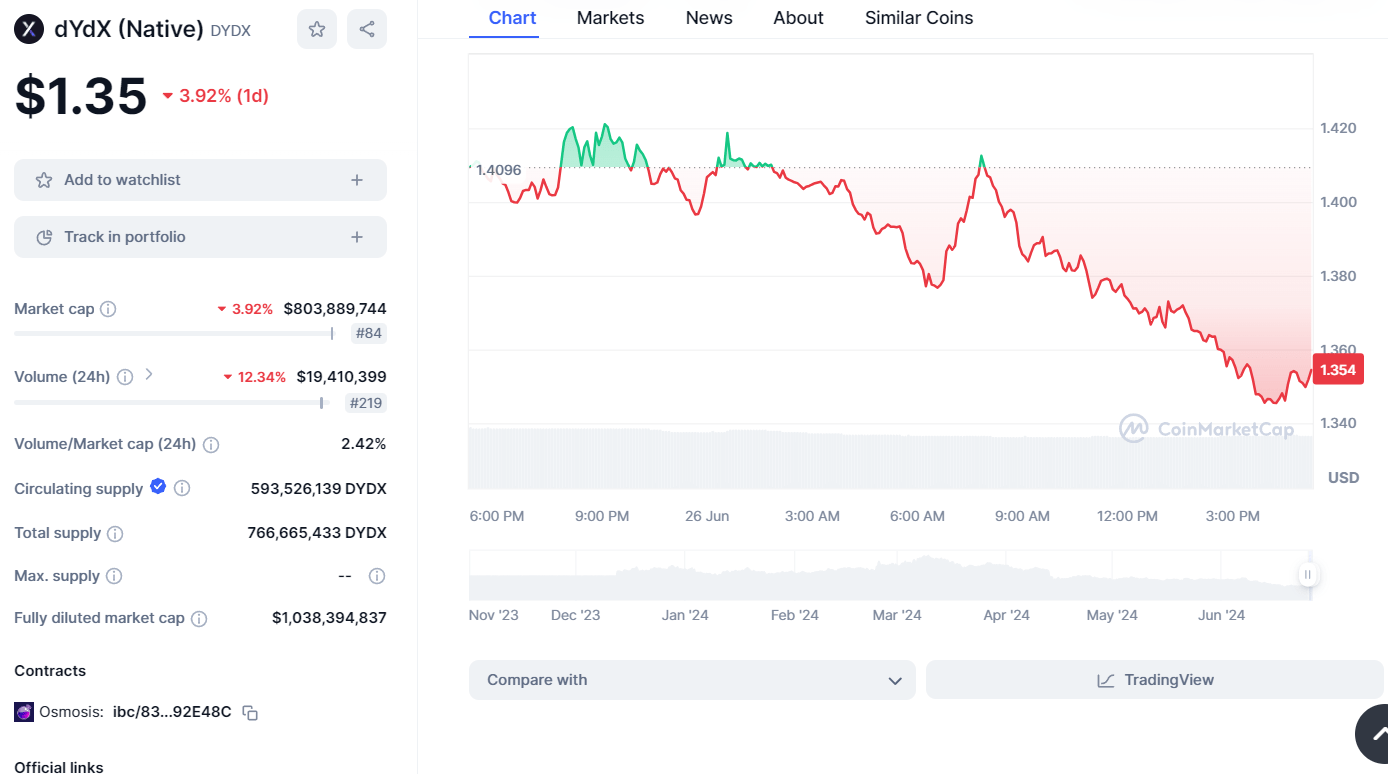

In the vibrant and evolving world of decentralized finance (DeFi), dYdX, a prominent decentralized exchange, is witnessing a steady rise in its market presence and investor interest. Over the last day, dYdX’s native token, DYDX, has seen a price increase of 3.93%, reaching $1.35. This surge reflects the ongoing enthusiasm and trust in dYdX’s capabilities and its role in facilitating advanced financial operations without intermediaries.

Currently, dYdX’s market capitalization has grown by 4.13%, amounting to $803,810,076, positioning it as the 84th largest cryptocurrency by market cap. This growth not only signifies a robust validation of its market model but also highlights its increasing relevance in a competitive market that values transparency, security, and efficiency.

The trading volume of dYdX has risen to $19,411,387, marking an increase of 12.37%. This places the platform at 219th in terms of cryptocurrency trading volumes globally. A volume-to-market cap ratio of 2.42% illustrates a healthy trading environment with sufficient liquidity. This liquidity is essential for users who seek to execute large trades quickly and at predictable prices, a vital characteristic for professional traders who utilize the platform.

Examining the tokenomics, dYdX has a circulating supply of 593,526,139 DYDX, out of a total supply of 766,665,433 DYDX. The absence of a defined maximum supply could raise questions about potential future inflation. However, it also provides the network with flexibility to incentivize participation and maintain network security through token distributions if necessary.

The fully diluted market cap of dYdX, assuming all tokens were to be circulated at the current price, stands at approximately $1,036,610,690. This metric is crucial for investors as it offers a comprehensive view of the token’s valuation potential, taking into account all tokens that will ever exist under current market conditions.

The recent performance of dYdX can be attributed to several factors. The platform’s core offering—decentralized margin trading, spot trading, and derivatives—is increasingly aligned with the market demand for more sophisticated financial tools within the DeFi ecosystem. This demand is driven by both retail and institutional investors looking for alternatives to traditional financial systems which often come with higher costs and regulatory hurdles.

Moreover, the growing recognition of DeFi platforms that offer high levels of autonomy, combined with recent enhancements in blockchain technology and smart contracts, are likely contributing to dYdX’s positive market momentum. Innovations such as layer-2 scaling solutions have also played a critical role, significantly reducing transaction costs and improving transaction speeds on the platform.

For potential investors and current users of the dYdX platform, the current trends suggest a promising outlook. However, the inherent volatility of cryptocurrency markets and regulatory uncertainties surrounding DeFi necessitate careful consideration of risk factors. The platform’s ability to sustain growth amidst competitive pressures and technological challenges will be key to its long-term success and relevance.

In conclusion, dYdX’s recent market performance underscores the growing appetite for decentralized financial services that offer enhanced transparency and efficiency. As the platform continues to innovate and adapt to user needs and market conditions, it remains a significant entity in the landscape of cryptocurrency and decentralized finance.

+ There are no comments

Add yours