Exploring the phenomenon of cryptocurrencies and the unpredictable fluctuations in AKT as a specific kind of resource in the network. When having a look at AKT which is going through a very volatile day with a large change in prices, it becomes fitting to discuss the numbers which will give a comprehensive picture of its current situation as well as the further potential.

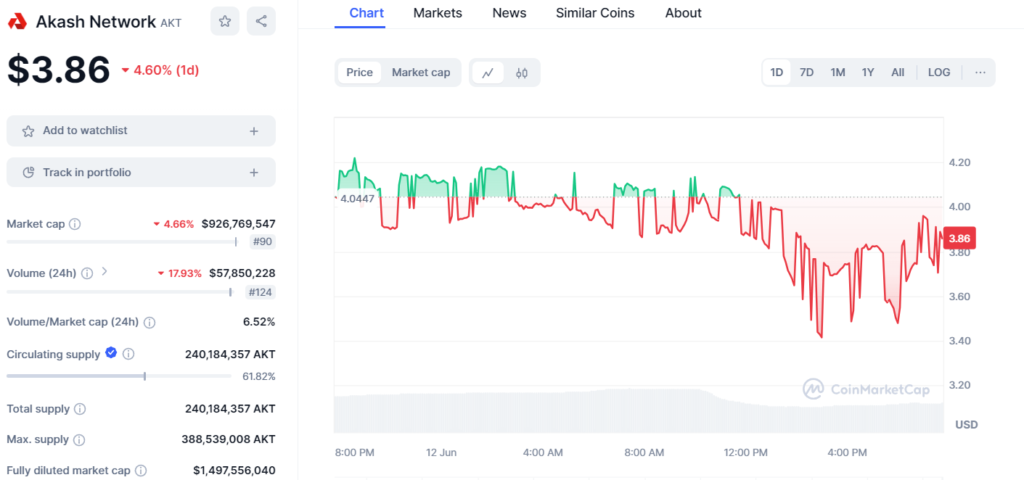

Currently priced at $3. 86; however, Akash Network has seen a huge decline of 4. New cases: 60% within the last 24 hours. This movement is not isolated and it belongs to the same class of high fluctuation typical of cryptocurrencies. Despite this, the total market value of Akash Network is still stable at around $926,998,861, making it ranked the 90th largest cryptocurrency by market capitalization. Such metrics are a sign of not just investor confidence, but also an illustrative dynamic that can shift the territory in hours or days.

Going deeper into the analysis of trading volume, the observable figure was recorded to have reduced by 17. 93% and their total worth was worth 57$billion. It reported that the daily turnover of its shares stood at 85 million in the past day. This lower level of trading may be attributed to the fact that some traders may be taking a break from trading following their recent trading activities or could result from other outside economic influences for the investors. However, the volume/market cap ratio is rather quite low and currently gives a figure of 6. 52% which suggests a relatively sound liquidity position that does not allow sharp traders to enter or exit the trade without affecting the price.

The information about the supply aspects of Akash Network adds more layers to the identification of its market. Thus, the circulating supply of AKT tokens is 240,184,357 with 61% of it tied to the total value of the assets. which is only 82% of its total supply capped at the same number; suggests that there is a clear boundary put in place for this virtual currency’s short-term supply. This also shows that the maximum total outstanding supply of AKT is 388,539,008 which will point to other factors likely to affect inflationary factors on its value in the future.

The additional value that Akash Network brings in as a decentralized cloud computing platform is beyond the measurable and speculative market value. It has the goal of offering an improved and cheaper solution than traditional cloud services through the process of offering blockchain security for the decentralized execution of cloud services. It is apparent from the above proposition that not only advanced investors but also those that are interested in applications that may disrupt larger players in the cloud computing industry in the future.

Thus, if cryptocurrency analysts and investors are to understand Akash Network, it is necessary to delve deeper into these numbers couched within the context of the overall market and the particular technological sector of the AKT. Analyzing results involves another set of considerations including technology adoption, market feeling, regulation, and competition to provide the best advice.

AKT’s variability in Price and trading indicators remains an embodiment of the Cryptocurrency market volatility. It is for these dynamics that analysts are forced not only to forecast probable shifts in price in the future but also to evaluate the value created by Akash Network’s technological solutions in the decentralized web.

Thus, experience with Akash Network demonstrates that investing in the blockchain sector may be highly unprofitable but also has the ability to solve a number of current problems. Informed analysis will be the key to its effective exploration as the market continues to deepen and prospective opportunities in the market to be seized in the future.

+ There are no comments

Add yours