Notcoin (NOT) is one of the prominent coins that have made waves in the cryptocurrency world within the industry’s current fast-growing nature and trading of different tokens on famous platforms such as Binance. The current paper aims to review market trends in Notcoin and evaluate its value regarding investment opportunities and its recent prices.

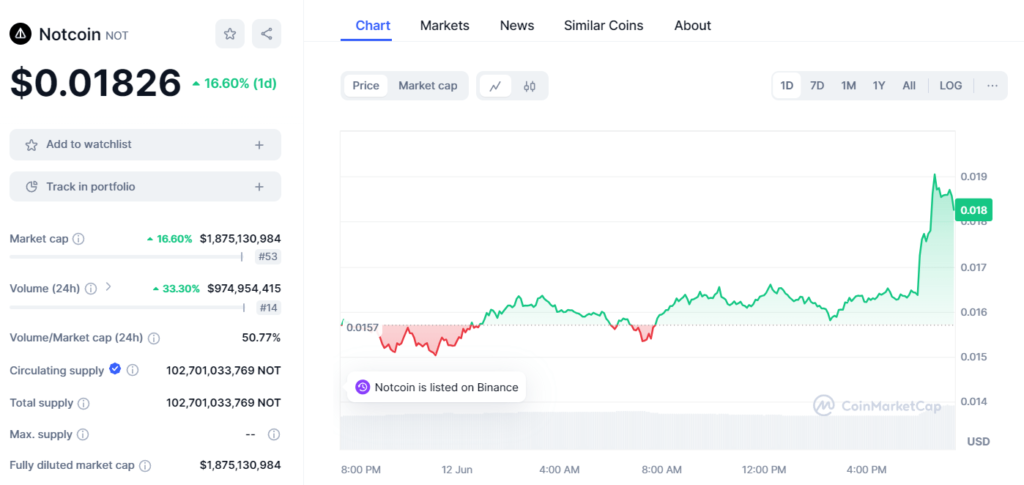

It is important to note that in December the market value of Notcoin rose by 16 percent. It pointed to Bitcoin’s volatility, which saw it drop to 60 percent in one day, thus pushing its price to $0. 01826. This has helped in increasing the market capitalization of more than one billion dollars to the organization. As of December 2020, its market capitalization was $ 875 billion, which puts it at number 53 among cryptocurrencies in terms of capitalization. Such metrics prove to be useful for investors and analysts as well since it can reveal the general price of the coin and its stability that is seen by investors.

Among the noteworthy characteristics of Notcoin’s recent activity, it is quite possible to place the growth in trading volume by 34%. Used by 25% of them, these applications generated close to $972 million in the past 24 hours alone. This high number when compared to the market cap means that the company has a volume/market cap of fifty. 77%. This ratio is very very high, indicating that a very high level of activity is going on within the market and that a high percentage of the total market capitalization is exchanged each day. It is always better to a certain extent; high liquidity is always better as it means that the market is capable of handling large trades without the prices having to move much, but it also means high volatility.

With regard to the supply metrics of Notcoin, there is another significant point of discussion. Because the total and circulating supply of Dashcoin is nearly about 102. 7 billion NOT, the Notcoin token has no upper limit to its supply making it potentially have an unlimited supply. This setup can cause worries in regards to inflation in the long run; the increase in supply puts pressure on the value of the circulating coins considering that the demand has to rise in tandem with the supply.

The latest event was the listing of Notcoin in the Binance exchange platform which is also a significant step. Usually, such listings can be viewed as signals of the token’s gradually obtaining legitimacy and expanding the number of enthusiasts and investors within the crypto space. Admittance of coins to major exchanges not only enhances its market exposure but also enhances its liquidity which increasingly attracts gigantic firms and retail users.

The task of determining why Notcoin has grown over the past two months, as well as its further growth or decline, has a composite value that combines technical analysis, tendencies in the market, influence of various sentiments, and global economic factors. Technical analysts would be required to break down the number of transactions per day, up and down swings in price, or other important events related to Notcoin and the current scenario of the market along with changes in regulations before giving a balanced view on its investment opportunities.

In conclusion, Notcoin is a good example case in the analysis of a cryptocurrency, proving that the presented market can be highly unpredictable, yet equally profitable. As with everything, both threats and opportunities are most likely to arise as the segment grows, and that means investors are going to have to stay vigilant and adaptable to changes in the market.

+ There are no comments

Add yours